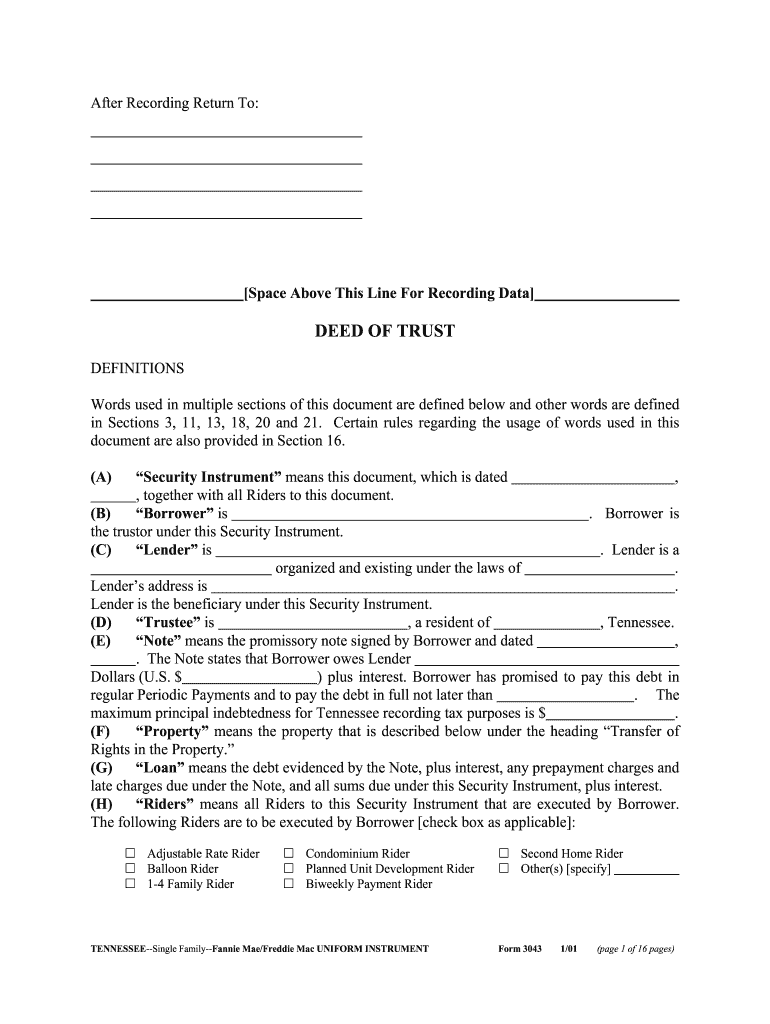

TN Freddie Mac/Fannie Mae Form 3043 2001-2024 free printable template

Get, Create, Make and Sign

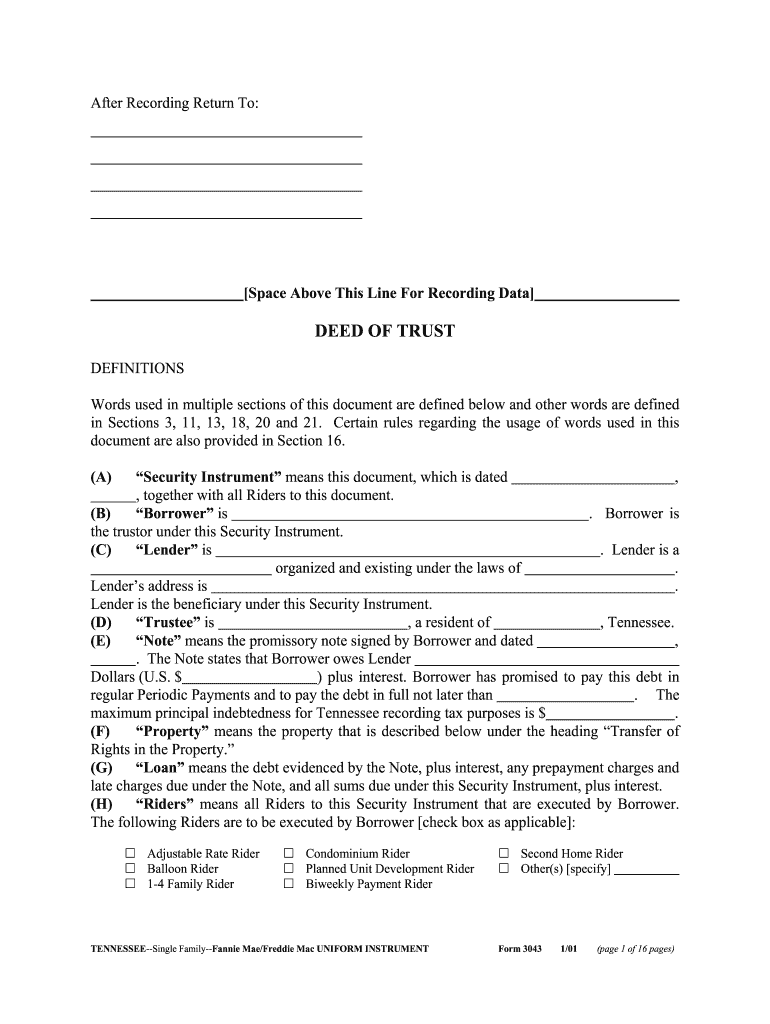

How to edit tennessee deed of trust form online

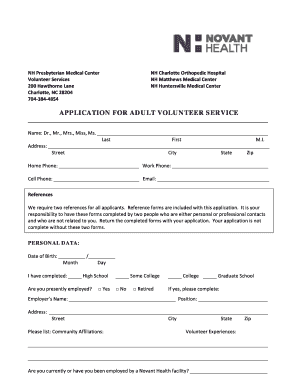

How to fill out tennessee deed of trust

How to fill out tn deed trust:

Who needs tn deed trust:

Video instructions and help with filling out and completing tennessee deed of trust form

Instructions and Help about sevier county tennessee deed form

Mortgages many legal authorities choose the name mortgages as a title for the material in this lecture because they were forced to by popular convention however this lecture is really about how a lender can use real property to assure repayment of a loan another way that lawyers refer to this topic is debt financing secured by real property in fact there are many ways to describe the material in this lecture because the terminology includes multiple names for the same things, but this should not intimidate you because this material is conceptually easy while the name mortgages isn't necessarily the best way to title this lecture it is being used as the title for two reasons because in some odd way the word mortgages is more appealing than for example debt financing secured by real property and because the title mortgages is sort of a joke which makes the material easier to remember at a certain point in this lecture you will learn about the conflict in the word mortgage there's a conflict because of how often the word mortgage is misused since the misuse of the word mortgage is counterintuitive and at the least surprising most students have a hard time forgetting that the word mortgage is misused and more importantly it is easier to remember why it is misused thus by naming the title of this lecture mortgages you have been made part of an inside joke which is hard to forget to begin let's consider the common scenario when someone borrows money normally when a lender loans money to a borrower they want to get paid back to motivate the borrower to repay the loan and to prevent a loss at the borrower cannot repay the loan the borrower will grant the lender the right to take something that the borrower already owns thus the borrower makes two promises he makes one promise to repay the lender, and he makes a second promise to give up something to the lender if he cannot repay the loan in this lecture as you might have already guessed that something is real property for example a house or land these two promises become two documents that the borrower must execute the first promise becomes a promissory note or note for short and the second promise becomes a mortgage or a deed of trust this is where the term mortgage becomes confusing first off it is common for people to refer to the entire loan arrangement as a mortgage second it is common for people to refer to the deed of trust as a mortgage that's when someone references a mortgage that could be talking about the entire loan arrangement between the borrower and the lender, or they could be talking about the actual mortgage document, or they could be talking about the deed of trust document which is not a mortgage and all people make the mistake of referring to the deed of trust as a mortgage because they are very similar in fact the deed of trust is often treated as a mortgage before we begin our discussion on the difference between the two please note the following material is discussed in a...

Fill deed of trust release form tennessee : Try Risk Free

People Also Ask about tennessee deed of trust form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tennessee deed of trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.